Effective January 1 1987. Cambodia NIL 10.

1 January 1999 for taxes.

. Country Fees for Technical Services 1 Albania NIL 10 10 10 2 Australia NIL 15 10 NIL. Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the. The Government of Malaysia and the Government of the Republic of Indonesia desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as follows.

The Singapore-Malaysia Double Tax Treaty. Agreement between the government of malaysia and the government of the hong kong special administrative region of the peoples republic of china for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income the government of malaysia and. Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the Contracting States.

Withholding tax is a method of collecting taxes. Dezan Shira Associates is a specialist foreign direct investment. Any gains derived from the alienation of property.

The text of this Agreement signed on 26 December 1968 and is shown in Annex B. Ii To claim the DTA rate please attach the Certificate of Tax Residence from the country of residence. English Version Done on November 23 1985.

Prevention of fiscal evasion withrespect to taxes on income. The Government of Malaysia and the Government of Finland desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as follows. Bahrain NIL 5 8 10 5.

AGREEMENT BETWEEN THE GOVERNMENT OF MALAYSIA AND THE GOVERNMENT OF THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON. The following income categories are covered by the double tax treaty. There is no withholding tax on dividends paid by Malaysia companies.

Austria NIL 15 10 4. 10 December 1996 Effective Date. Dezan Shira Associates is a specialist foreign direct investment practice providing corporate.

Double Taxation Agreement between China and Malaysia. Bosnia Herzegovina NIL 108 8. In the Malaysian context a DTA is usually signed by a cabinet minister or sometimes by.

Australia NIL15 10 3. The Double Taxation Agreement entered into force on 8 July 1998 and was amended by a protocol signed on 22 September 2009. 78 rows Double Tax Treaties and Withholding Tax Rates.

The Government of Malaysia and the Government of the Republic of Korea desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as follows. In order to facilitate the cross-border flow of trade investment financial activities and technical know-how between the two countries the governments of Malaysia and Singapore have signed Avoidance of Double Taxation Agreement DTA. REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME MALAYSIA AND THE FEDERAL REPUBLIC OF GERMANY DESIRING to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as.

Belgium NIL 10 10 7. Income derived from personal services. Bangladesh NIL 15 10 6.

Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the. The Government of Malaysia and the Government of the Republic of Singapore desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as follows. 1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status.

DOUBLE TAXATION AGREEMENTS WITHHOLDING TAX RATES EFFECTIVE DOUBLE TAXATION AGREEMENTS Rates No Country Dividends Interest Royalties Technical Fees 1. Profit derived from business. Brunei NIL 10 9.

Singapore and the Government of Malaysia for the avoidance of double taxation and the. 19 rows What is a double tax agreement. Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the.

A double tax agreement is an agreement between two. Albania NIL 10 2. As the name suggests a double tax agreement is an agreement or a contract regarding double taxation or more correctly the avoidance of double taxation.

There was an earlier Agreement signed between the Government of the Republic of. AGREEMENT BETWEEN THE GOVERNMENT OF MALAYSIA AND THE GOVERNMENT OF AUSTRALIA FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME. Income derived from immovable property.

20 August1980 Effective Date. DOUBLE TAXATION AGREEMENTS WITHHOLDING TAX RATES No. Singapore and Malaysia have endeavored to foster a congenial relationship despite.

Double Taxation Avoidance Agreement between Malaysia and the United States of America. The agreement is effective in Malaysia from. THE GOVERNMENT OF MALAYSIA AND THE GOVERNMENT OF.

Tax Guide For Expats In Malaysia Expatgo

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

Lease Extension Form Download Pdf Document Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

Nre Vs Nro Vs Fcnr Which Savings Or Fixed Deposit Account Nri Should Open Nri Saving And Investment Tips Savings And Investment Investment Tips Investing

Can You Send Money From Abroad To A Normal Indian Savings Account Will It Be Taxable Send Money Banking Savings Account

Explained Double Taxation Avoidance Agreement Dtaa Youtube

Double Taxation Agreements In Malaysia Acclime Malaysia

Advantages Of Double Taxation Agreement Abc Of Money

Individual Income Tax In Malaysia For Expatriates

Account Abilitys 1099 A User Interface Acquisition Or Abandonment Of Secured Property Data Is Entered Onto Windows That Resemble The Ac Irs Forms Irs Efile

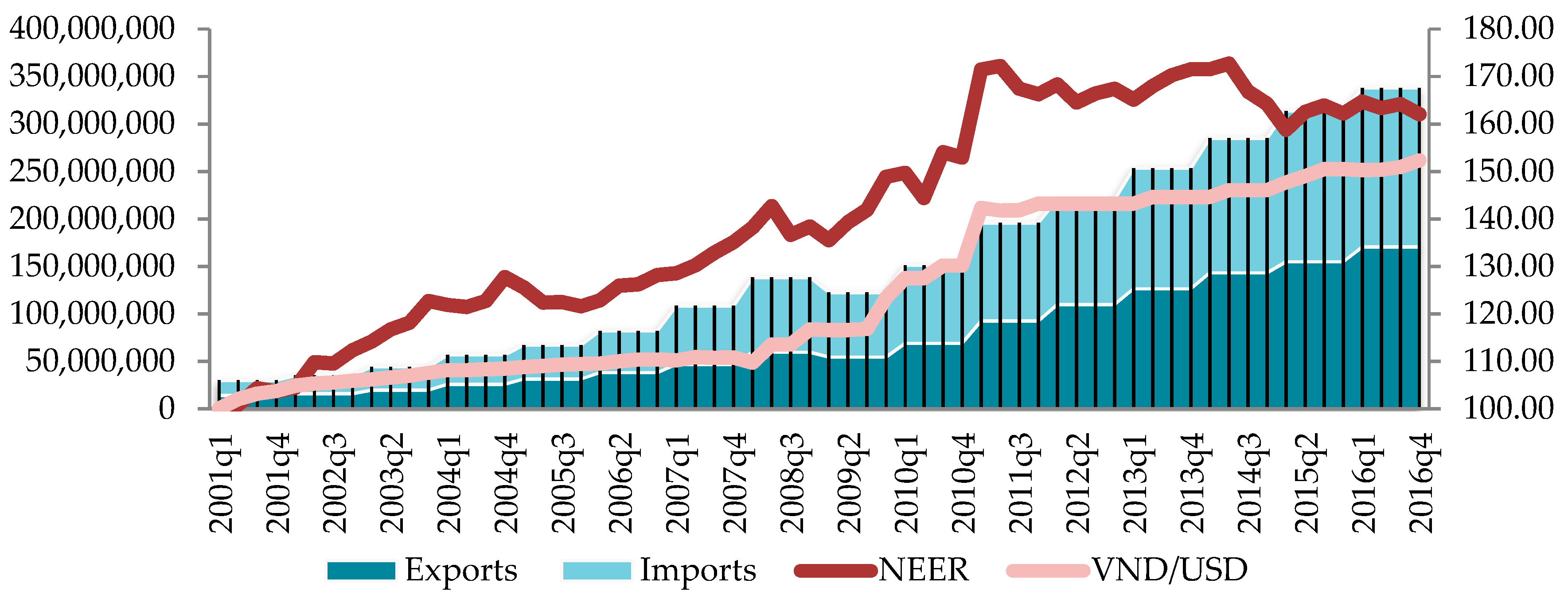

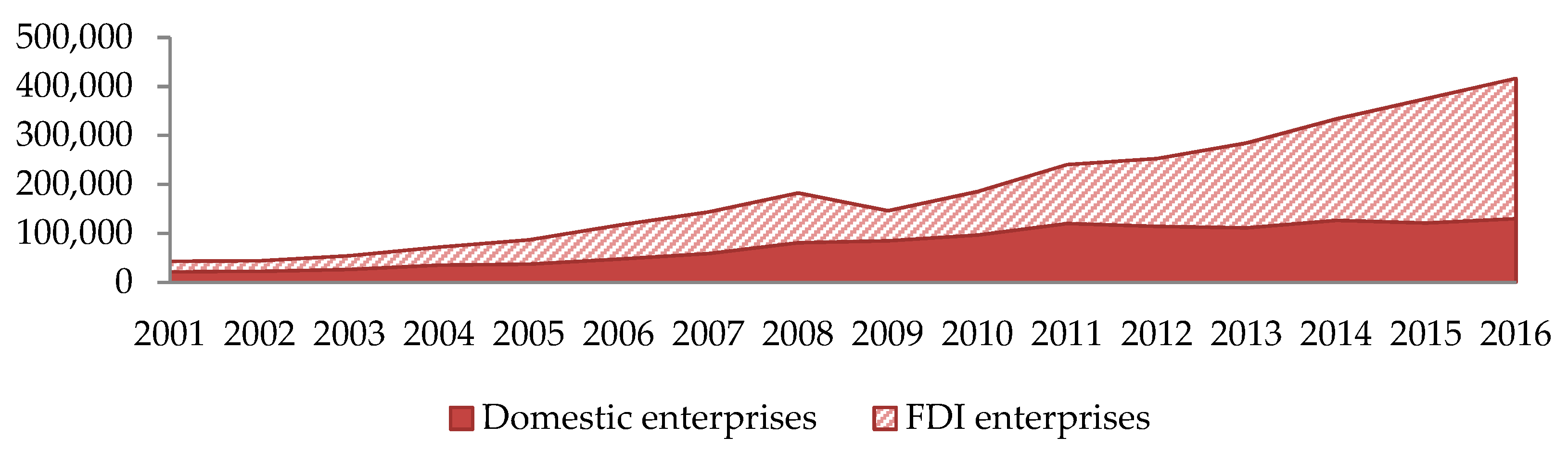

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Inventory Letting Template Rental Agreement Templates Being A Landlord Lease Agreement

How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help Invoicing Financial Accounting Tax

Tax Guide For Expats In Malaysia Expatgo

Withholding Tax Service Tax On Imported Services For Digital Ads Services

Double Tax Avoidance Agreement Dtaa Advantages And Misuse

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Advantages Of Double Taxation Agreement Abc Of Money